Rate Decisions

Rate Decisions

Recent Bank Failures Pressure Markets and Fed on Rate Decisions

One more rate hike and then pause? Leading economic indicators have turned deeply negative. Inflation is down to 5% from the high of 9.6%. Markets are now pricing in rate cuts before year end.

The Fed could and should pause here, but may not. This has been the fastest rise in rates in history, and there usually is a lag between rate increases and economic slowdown observable through data.

Impact of Tighter Standards

Tightening Standards Will Slow Down Economy Further

Consumers and businesses already are experiencing the negative impacts from the higher cost of borrowing. The recent bank failures and concerns about the stability of checking deposits also may tighten lending standards further.

There is a risk that banks will adopt a more cautious approach to lending and further reduce the total amount of credit they offer due to the uncertain timing of depositor withdrawal requests.

The decreased credit supply and access to credit could have a domino effect, impacting the economy and financial markets over time.

Labor Market

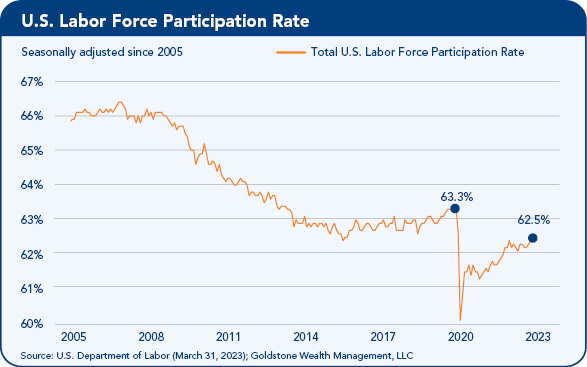

Labor Market Participation Rebounds Despite Early Retirements

Labor market tightness was a contributing factor to high inflation during the pandemic recovery.

Economic activity soared, labor supply tightened, and businesses struggled to find enough employees. As a result, employers raised wages to keep their current employees and attract new employees, which drove wage inflation.

Wage inflation moderated as the participation rate rebounded, which has helped ease inflation pressures.

However, if the participation rate remains weak, labor markets could continue to be a source of inflationary pressures in coming years.

Global Oil

Global Oil Prices Drop to 16-Month Low Due to Demand Concerns

The steady rise in oil prices from 2020 through the first half of 2022 sent headline inflation skyrocketing across the globe.

However, data shows inflationary pressures are easing, with the year-over-year growth of inflation declining each month since peaking at +8.9% y/y in June 2022.

If oil prices stabilize or continue their downward trajectory, it could offer relief from soaring inflation and allow central banks to slow their pace of tightening. If crude oil prices reverse higher, inflation pressures could remain sticky.

Housing

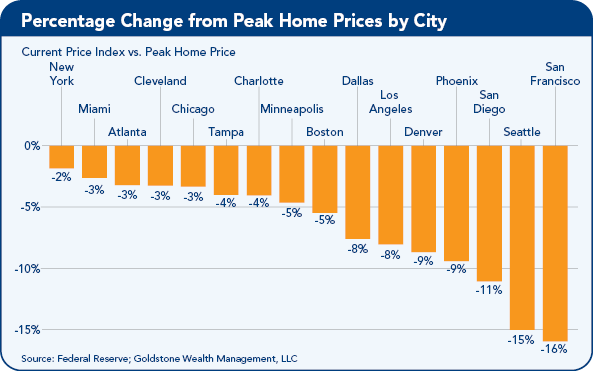

Housing Market Cooling Off with San Francisco and West Leading Decline

Higher mortgage rates have made monthly payments significantly more expensive and homeownership more difficult for many potential homebuyers, causing demand to dry up and home prices to reverse lower.

Home prices are down across most U.S. cities. With mortgage rates still elevated and banks tightening lending standards, there could be room for home prices to decline further.

The one factor that may stabilize home prices — homeowners that locked in low interest rates during the past few years have little incentive to sell their homes and finance a new home loan at current interest rates, which may limit housing supply and in turn prevent a significant decline in home prices.

Corporate Profits/Small Business

Corporate Profit Margins & Small Business Survey Results

There are two primary takeaways to point out.

• First, corporate profit margins rose significantly during the pandemic as economic activity accelerated and pricing power allowed companies to more than pass through their increased costs.

• Second, profit margins tend to decline when the economy contracts, such as the 2008 financial crisis and early in the COVID pandemic. Profit margins contracted in recent quarters, and investors will be watching earnings closely to see if margins stabilize in the coming quarters.

Small business owners see wages and prices continuing to rise during the next three months, but forecast a more muted sales outlook with expectations for lower sales.

Pricing power and expense management will be key for defending profit margins, particularly against a backdrop where demand may start to fade.

Equities Performance

U.S. Equities Performance Sees Growth Come Back into Fashion Versus Value

The worst performing sectors in 2022 are the top performing sectors in 2023, while 2022’s top performing sectors are broadly underperforming to start 2023.

Growth sectors significantly underperformed in 2022 as the Federal Reserve’s interest rate increases weighed on expensive growth stock valuations. Growth stocks tend to be higher-quality businesses with stronger fundamentals.

The performance reversal suggests investors took advantage of growth’s oversold nature and superior fundamentals to rotate into higher-quality companies after bank failures raised concerns about the U.S. financial system’s stability.

Corporate Earnings

Can Corporate Earnings Hold Up to Support Market Valuations and Price-to-Earnings Ratios (P/Es)?

The Standard & Poor’s (S&P) 500’s earnings multiple soared early in the pandemic as the Federal Reserve cut interest rates to 0%, and for most of 2021, trended sideways to slightly lower as corporate earnings rebounded and the S&P 500 grew into its valuation.

The earnings multiple then collapsed in 2022 as the Federal Reserve aggressively raised interest rates, which weighed on expensive growth stock valuations.

As of the end of the first quarter, the S&P 500 trades approximately 18 times its next-12-month earnings versus the average of 16 times since 2000. Current multiples are in line with the range from 2015–2020.

The next test for the S&P 500 is earnings, with the first quarter 2023 earnings season to start in mid-April.

Staff Contact: Nicole Wasylkiw

This economic outlook report is adapted from the special report presented to the CalChamber Board of Directors by Dr. Sanjay Varshney, Ph.D., CFA, principal, founder and chief economist, Goldstone Wealth Management, LLC.

economic outlook report is adapted from the special report presented to the CalChamber Board of Directors by Dr. Sanjay Varshney, Ph.D., CFA, principal, founder and chief economist, Goldstone Wealth Management, LLC.