Recapping a Challenging 2022

Markets faced several challenges in 2022, including high inflation, historic central bank policy, the war in Ukraine, and COVID lockdowns in China. Inflation was a major factor in the markets throughout the year, with the headline consumer price index reaching a 40-year high of 9.1% in June.

High inflation prompted the Federal Reserve and its global central bank peers to aggressively raise interest rates, which caused stocks and bonds to trade lower. There was no place to hide as central banks rapidly tightened monetary policy.

The Standard and Poor’s (S&P) 500 returned -19.4% in 2022, its worst annual return since 2008, and the Bloomberg U.S. Bond Aggregate produced its worst total return since 1976. This article reviews the fourth quarter, recaps a difficult 2022, and discusses what the market will be focused on in 2023.

2022 Interest Rate Hikes

The main story of 2022 was the reversal of monetary policy from extraordinarily accommodative levels during the COVID-19 pandemic. The speed and size of interest rate increases was evident as central banks worked to bring inflation under control.

For example, central banks across the globe raised interest rates by a total of 68% from September to November 2022. In contrast, the total amount of interest rate cuts during that same period was only 4%. As the data shows, 2022 was the quickest, largest, and most imbalanced global tightening cycle since the late 1990s.

The pace of interest rate increases is forecasted to slow during 2023. Central banks continue to hint that they are approaching the end of their interest rate hike cycle, citing concerns that further tightening could push the economy into recession.

In addition, data suggests price pressures are easing. While the year-over-year headline consumer price index rose by 7.1% in November 2022, which is still high compared to historical levels, it was down from the 9.1% rate seen in June 2022.

As inflation and central bank policy return to normal, a new uncertainty is emerging — the unknown effects of 2022’s rate hikes.

Data Lag

Markets Wait for the Lagged Effect of Higher Interest Rates to Show Up in Economic Data

The Federal Reserve’s interest rate hikes occurred in 2022, but the full impact of its restrictive measures has not yet been felt fully in the real economy.

While the U.S. economy contracted during the first half of 2022, it expanded at a robust +3.2% annualized pace during the third quarter. Consumer spending remained strong throughout most of 2022 despite high inflation, and the U.S. labor market added more than 4 million jobs through the end of November.

The data indicates the U.S. economy has withstood tightening thus far, but the real test will come in 2023 as the cumulative impact of higher interest rates becomes clearer. While a recession is not a foregone conclusion, it is possible the economy could be tested in 2023.

An index of leading economic indicators shows the U.S. economy is already starting to slow as the impact of higher interest rates takes hold.

The Conference Board’s Leading Economic Index tracks 10 economic components that tend to precede changes in the overall economy. Included in the components are the average weekly hours worked by manufacturing workers, new home building permits, and the volume of new orders for capital goods, such as equipment, vehicles, and machinery.

The Leading Economic Index has decreased every month since March 2022, an indication the economy is slowing after a period of strong growth during the pandemic recovery.

Corporate Earnings

Equity Valuations Are More Attractive, But Corporate Earnings Are An Open Question

Whereas inflation and central bank policy were the primary drivers of markets in 2022, economic data and corporate fundamentals are expected to play a larger role in determining the market’s direction in 2023.

Two important S&P 500 metrics are:

• The next 12-month price-to-earnings ratio, which divides the S&P 500’s projected next 12-month earnings by its current price. Valuation multiples expanded during the pandemic as interest rates were cut to near 0% before reversing lower during 2022 as rising interest rates weighed on company valuations.

While current valuations are at a more attractive starting point today than at the beginning of 2022, corporate earnings are an open question entering 2023 with the potential for an earnings reset as the economy slows

• The S&P 500’s trailing 12-month earnings growth. There was a jump in corporate earnings during the pandemic.

Despite expectations for an economic slowdown, Wall Street analysts still forecast single-digit earnings growth for the S&P 500 in 2023. The positive earnings growth forecast is encouraging, but it creates a risk for the market. If actual earnings growth falls short of the forecast, stock prices could decline as markets price in lower actual earnings.

Equity Market Recap

Stocks Trade Higher in 4Q ’22

Stocks traded lower during December but still ended the fourth quarter higher. The S&P 500 Index of large cap stocks returned +7.6% during the fourth quarter, outperforming the Russell 2000 Index’s +6.2% return. The Dow Jones Index, which includes large companies such as Visa, Caterpillar, Nike, and Boeing, was the top performer, returning +15.9%, while the Nasdaq 100 Index of technology and other growth-style stocks produced a -0.1% return during the fourth quarter.

Energy was the top performing S&P 500 sector during the fourth quarter, followed by the cyclical sector trio of Industrials, Materials, and Financials. Defensive sectors, including Health Care, Consumer Staples, and Utilities, were middle-of-the-pack performers. Growth-style sectors, including Technology, Communication Services, and Consumer Discretionary, and interest-rate sensitive Real Estate underperformed as higher interest rates continued to weigh on valuation multiples.

International stocks outperformed U.S. stocks during the fourth quarter. The MSCI EAFE Index of developed market stocks returned +17.7% during the fourth quarter, while the MSCI Emerging Market Index returned +10.3%.

A weaker U.S. dollar boosted the returns of international stocks, with U.S. dollar weakness driven by a shrinking monetary policy gap as other central banks catch up with the Federal Reserve’s aggressive policy.

Separately, China’s decision to relax its COVID-zero restrictions raised the prospect of stronger global growth as one of the world’s biggest economies reopens.

Bond Market Recap

The Great 2022 Yield Reset

The bond market experienced a significant resetting of interest rates during 2022, with yields steadily rising as the Federal Reserve pushed through large interest rate hikes. Despite posting positive returns during the fourth quarter, bonds produced significant losses during 2022 as central banks raised interest rates at a rapid pace.

The Bloomberg U.S. Bond Aggregate produced a -13% total return during 2022, its biggest negative total return since tracking began in 1976.

Examining the state of the credit market after 2022’s rate hikes shows the 10-year Treasury yield sits at its highest level since 2007. Yields are now higher across most credit classes, and investors can earn a yield of around 4% to 5% on a portfolio of high-quality bonds, such as U.S. Treasury bonds and investment grade corporate bonds, without locking up capital for long periods of time.

In the corporate credit market, the high-yield corporate bond spread, which is the extra yield investors demand to loan to lower quality borrowers, is in line with its median since 1999.

The starting point for bonds, both in terms of yield and credit spreads, is now more compelling than it has been in a long time. However, there is still the potential for continued volatility in the bond market. There is still significant uncertainty regarding how high the Fed will need to raise interest rates and how long it will need to keep interest rates at restrictive levels to bring inflation down to normal levels.

There is a risk that inflation could remain above the Fed’s 2% target, leading to an extended tightening cycle. At the same time, the economy is likely to start feeling the effects of 2022’s rate hikes in 2023, which could make bonds more attractive. The crosscurrents of uncertain central bank policy and a volatile global economy could keep interest rate volatility elevated and test bond investors’ nerves again during 2023.

California Update

• The unemployment rate for California stood at 4.1% compared to 3.4% nationally with 15 consecutive months of nonfarm job gains.

• Year over year, California job growth (3.6%) has outpaced the United States as a whole (3.0%) by 0.6 percentage points and the state has 70,000 more jobs than pre-pandemic levels in February 2020.

• Nine of California’s 11 industry sectors gained jobs in December with Education & Health Services showing the largest month-over gains thanks to strength in Home Healthcare Services, Residential Care Facilities, and Individual and Family Services.

• Most recent data shows the state gross domestic product (GDP) at $3.6 trillion — perhaps ranking California now as the fourth largest economy in the world.

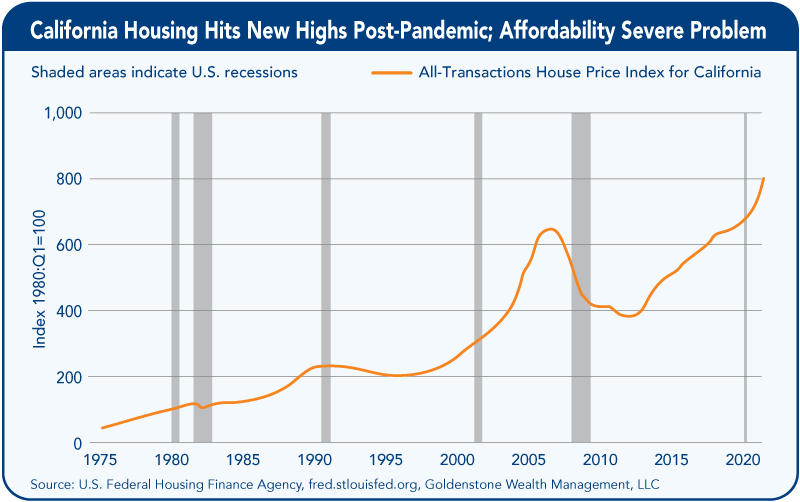

• The housing market keeps the state as one of the most unaffordable, although sales, permits and prices have seen a significant cooling off since the middle of 2022.

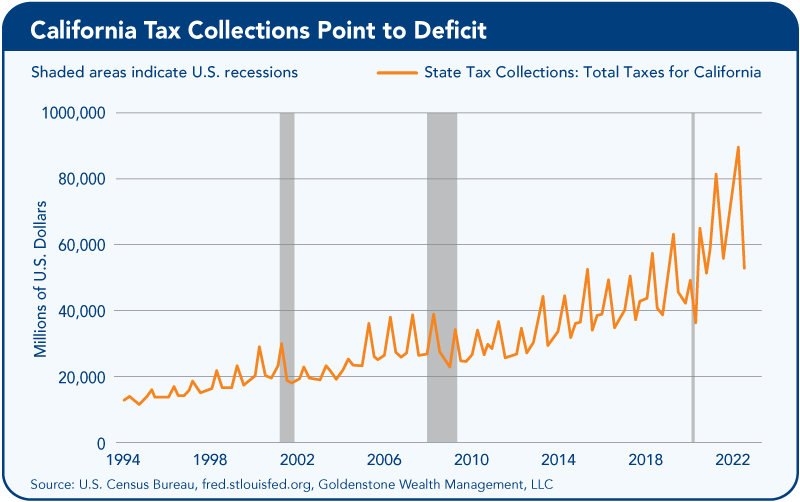

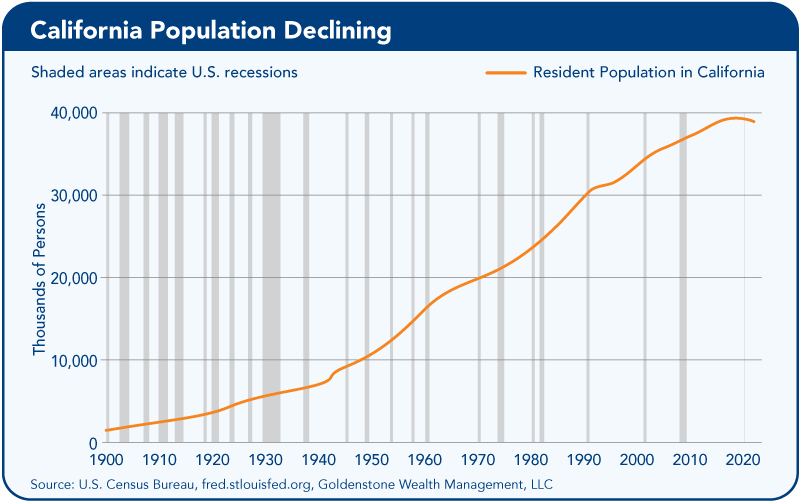

• California continues to lose population as people continue to move to more affordable states with more attractive taxes with the net negative migration being significant for four consecutive years. Those leaving are mostly at the lowest or the highest income levels. The top 1% of incomes account for almost half of the General Fund budget. The state Legislative Analyst’s Office (LAO) is expecting a budget shortfall in 2023 exceeding $25 billion — a radical swing from the $95 billion surplus form last year.

• Businesses continued to leave the state with significant announcements from Tesla, Oracle, Hewlett Packard, McKesson, and Charles Schwab recently.

• Other challenges confronting the Golden State include rising crime, homelessness, higher cost of living, higher cost of energy, Bay Area impact from technology job layoffs, and loss of business confidence.

2023 Outlook

Turning the Page on 2022’s Historic Tightening Cycle

2023 brings the next phase of the tightening cycle where the lagged effects of tighter monetary policy will be felt. It has the potential to be a year of two halves.

• In the first half, the focus is likely to shift from the number of future interest rate hikes to how much those interest rate hikes will slow the economy. Some data, such as the housing market, indicate that tighter monetary policy is being transmitted into the economy at a rapid pace. Home sales are slowing, and homebuilder confidence weakened every month during 2022 and now sits at its lowest level since 2012.

At the same time, consumers continue to spend, and employers continue to add jobs. There still is a wide range of possible outcomes, and the unique nature of the pandemic followed by rapid interest rate cuts and hikes makes the path forward less certain.

• The second half has the potential to be different depending on how severe the slowdown is in early 2023. Markets are based on forward-looking decisions, and investors will be watching closely for signs that the economy has bottomed and is recovering. Plus, there is an encouraging historical trend in the S&P 500 calendar year price returns. There have only been two instances of consecutive negative S&P 500 return years since 1950 — in 1973–1974 and 2000–2002.

This does not necessarily mean the S&P 500 will produce a positive return in 2023 or trade higher in a straight line from here, because it may not. However, it does provide helpful historical context in a volatile environment.

Staff Contact: Nicole Wasylkiw

This economic outlook report is adapted from the special report presented to the CalChamber Board of Directors by Dr. Sanjay Varshney, Ph.D., CFA, principal, founder and chief economist, Goldenstone Wealth Management, LLC.

This economic outlook report is adapted from the special report presented to the CalChamber Board of Directors by Dr. Sanjay Varshney, Ph.D., CFA, principal, founder and chief economist, Goldenstone Wealth Management, LLC.