Gross Domestic Product

Gross Domestic Product

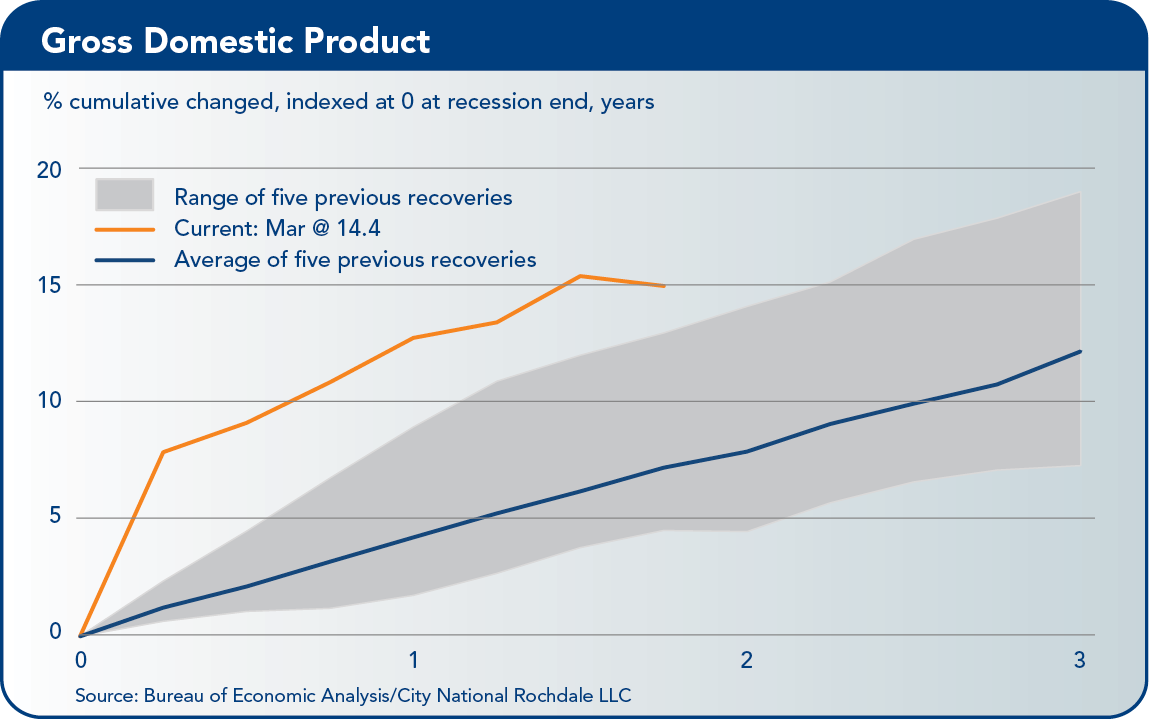

Gross domestic product (GDP) took a surprising decline in the first quarter of 2022, falling 1.4%. It was brought down by the trade deficit widening and a slower pace of inventory growth. However, the pace of consumer spending remains strong, increasing 2.7% quarter over quarter.

After a blockbuster level of growth in the fourth quarter of 2021 (up a sizzling 6.9% quarter over quarter and 5.7% year over year), a slower pace of growth was expected, not a decline. The powerful decline in net trade was not a surprise, as the monthly trade deficit has been at record levels as of late.

For GDP, imports surged 17.7% in the first quarter as consumers continued to snap up goods. On the other hand, exports fell 5.9% as domestic manufacturers grappled with supply snarls and foreign countries struggled with COVID-19 flare-ups.

For GDP, imports surged 17.7% in the first quarter as consumers continued to snap up goods. On the other hand, exports fell 5.9% as domestic manufacturers grappled with supply snarls and foreign countries struggled with COVID-19 flare-ups.

Inventory growth was unbelievably strong back in the fourth quarter of 2021, so a pullback was expected in Q1. Inventories are always a volatile component of GDP. Here is why. Inventories are a measurement of stock ($). In contrast, GDP is a measurement of flow ($/time), so to convert stock to flow, the change in inventories is measured ($/time). The change in the change of inventories is what contributes to GDP.

Due to the pandemic, swings in inventories have been significant. To give an example, in the third quarter last year, inventories fell $67 billion, and then in the fourth quarter, they rose $192 billion, adding 5.4 percentage points to GDP.

In the first quarter of 2022, they rose $159 billion — strong, but not as strong as the fourth quarter of 2021, so it subtracted 0.8 percentage points from GDP.

Consumer spending picked up a bit, increasing 2.7% quarter over quarter, compared with the fourth quarter of 2021 at 2.5%. Shopping habits are beginning to return to pre-pandemic trends.

Since January’s surge in omicron, cases have fallen, and Americans are resuming travel and dining out (services). That is replacing the pandemic binge shopping for exercise equipment, sofas, televisions and other goods needed to entertain the family, since they were home 24/7.

Despite the decline in first-quarter growth, this expansion continues on a steep upward trajectory, especially compared with past expansions. The GDP report does not alter our view of a multiyear recovery.

First, let’s put some context around this report: The unemployment rate is at 50-year lows, with plenty of jobs available; wages are up; and household balance sheets are solid.

When concerned about the risk of a recession, the first thing to look for is a sharp decline in domestic demand. We do not see that happening in the near term. What caused first-quarter GDP to be negative was demand being too strong. The trade deficit resulted from demand outpacing domestic production, so imports had to be increased to meet that demand. Inventories had trouble recovering because demand is too strong. This is why the Federal Reserve has to raise interest rates along the entire curve to slow the pace of demand.

For some, the concern is that the Fed will over-tighten and choke off demand. But with the interest rate still hovering around the emergency level of near-0%, the Fed needs to have several hikes to bring the rate up to the neutral level, never mind to a restrictive level.

Labor

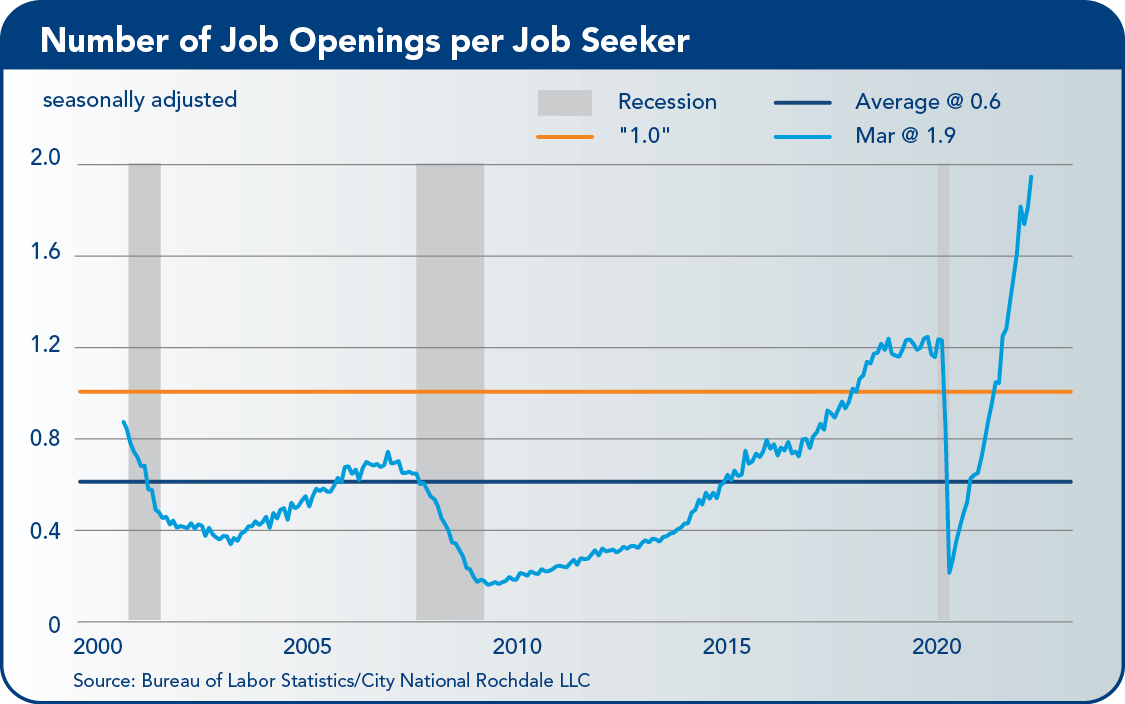

The labor market remains red hot. In the first four months of this year, payrolls have increased 2.1 million, which is considered a good rate of growth for a full year. There is evidence supporting a continuation of this strength.

There are now 11.5 million job openings, a record. That is about twice as many as the number of people looking for a job, which is 6 million. The number of people quitting jobs, presumably for another position that pays more, is also at record highs.

Layoffs are at low levels, as companies do not want to let workers go for fear they may not find a replacement when demand picks up. And finally, a recent survey by the National Federation of Independent Business found that firms have never had such a tough time finding workers.

This increased demand for workers is coming at a time when there is a lack of qualified candidates, which is putting upward pressure on wages. This is a concern for the Fed as it is trying to battle the elevated level of inflation.

Inflation

The good news is that the yearly change in the Consumer Price Index (CPI) appears to have peaked back in March at 8.5%, but the bad news is that inflationary pressures will not be falling quickly toward the Fed’s goal of 2%.

The main reason inflation was lower in April was a temporary decline in energy prices and the base effect. There was no evidence that the underlying price pressures were easing.

That said, there was some positive news that goods inflation increased just 0.2% month over month, but service inflation accelerated 0.7%, the largest one-month gain since 1990. This is telling us that the supply chain problems and the strong demand for goods, which occurred during the pandemic, appear to be declining but are being replaced by higher prices in the service sector. Higher housing costs and increased wages are keeping the heat high in service sector inflation.

Federal Reserve

The Fed needs to raise interest rates enough to slow the pace of overall demand. The Fed has its work cut out for itself. It needs to bring down inflation by reducing the amount of monetary stimulus to moderate demand, which should slow the pace of wage gains.

Thus, the Fed is taking a double-barreled approach to reducing its stimulus by raising short-term interest rates and quickly reducing the size of its bond portfolio. At its recent meeting, it raised the federal funds rate by 50 basis points (bps) and is making plans to raise the rate another 50 bps at the upcoming meetings in June and July. It will also allow bonds to mature out of the portfolio without reinvestment at a pace about twice as fast as the last time.

Based upon the Fed’s latest projection, they expect to have the federal funds rate at 1.9% at year end. That is slightly below their view of neutral fed funds (2.375%). The market expects the Fed to change their mind and be more aggressive with rate hikes this year.

This month, the Fed will begin to reduce the size of their balance sheet. They will allow up to $95 billion to mature each month, about twice as much as the last time they did this back in 2018.

The Fed is singularly focused on reducing the elevated level of inflation. As the Fed sees it, inflation is high due to demand outpacing supply. The large trade deficit, slowing inventory growth and the low unemployment rate are products of demand being greater than supply. The Fed cannot fix the supply shortages, but it sure can raise interest rates to slow demand.

This economic outlook report to the CalChamber Board of Directors was prepared by Paul Single, managing director, senior economist, senior portfolio manager, City National Rochdale.

This economic outlook report to the CalChamber Board of Directors was prepared by Paul Single, managing director, senior economist, senior portfolio manager, City National Rochdale.