Overview

The pace of economic growth continues to moderate, primarily driven by a slower pace of consumption, which accounts for about two-thirds of gross domestic product (GDP).

We do not believe the economy is in a recession yet, but the planned aggressive actions by the Federal Reserve to raise interest rates and reduce the size of its bond holdings may put the economy into a recession in 2023.

If a recession does happen, we believe it will be relatively mild due to the strength of household and corporate balance sheets and the stability of the banking system.

Washington, D.C.

The results of the mid-term elections show the purple fog is still here — for Congress; there is no mandate for one party over another, just a very slight majority.

Since it appears that both houses of Congress will no longer be leaning toward the Democrats, which has been the case for the past two years, this probably means that fiscal policy will take a back seat, as President Joe Biden will not be able to push through significant changes that require money, either spending or taxing.

It also means the debt ceiling will become a political toy, as the $31.4 trillion debt limit will need to be increased in early 2023.

The Fed

The Federal Reserve recently raised the federal funds rate by 75 basis points (bps) to 3.875%. The Fed has acknowledged that the federal funds rate is well above the neutral rate and in restrictive territory.

As a result, for future changes in monetary policy, it will consider the cumulative degree of tightening, and it will consider the aggregate lags inherent in monetary policy changes, and economic and financial developments. It will soon slow the pace of rate hikes, which have been 75 bps for the last four hikes.

This was an important move for the Fed. It is not a dovish pivot. But the Fed acknowledges that the 375 bps rate hikes so far this year will cause the economy to slow and inflationary pressures to decline. It just hasn’t shown up in the data yet due to the lag effect that monetary policy has on economic growth.

The Fed is just as hawkish as it was before the recent meeting. It still has more interest rate hikes planned for this year and next year because there is still a need. (Real Federal funds are still negative.) Fed Chair Jerome Powell stated that the slower pace should not be interpreted as signaling an imminent pause. He also indicated that the terminal rate might be higher than the 4.6% projection made in September.

The fear of the last few months has been that the Fed would continue to raise rates at a fast pace until inflation turned downward, which meant there was a high probability the Fed would overtighten and cause a recession. This decision to pay attention to the impact the rate hikes may have on the economy plays into the Fed’s hope of an economic soft landing.

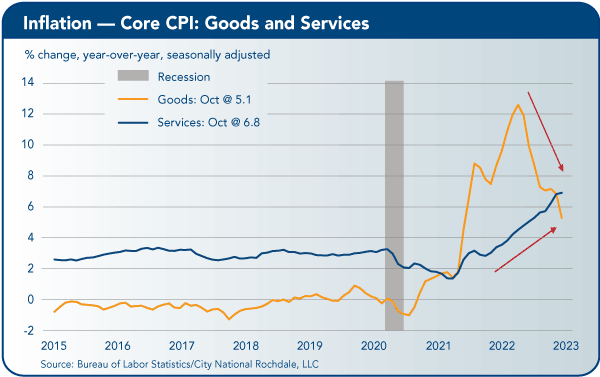

Inflation

Lower levels of inflation have begun in earnest. The current annual change in the consumer price index (CPI) fell to 7.7% from 8.2% last month and a recent high of 9.1% back in June.

After the November 10 release, there were impressive moves in the market. The Dow rallied 1,201 points (3.7%), the S&P 500 jumped 208 points (5.5%), and 10-year Treasury notes rallied 28 bps to yield 3.81%.

With all this good news, there is an important thing to remember: 7.7% inflation still is a really big number. A year ago it was 6.2%, and the Fed’s target rate is 2.0%. So the Fed will continue to raise interest rates until it is confident that inflation is on a clear path toward its target rate.

There is good news on the inflation front, as the much-anticipated “basis effect” is taking place. The large monthly increases in inflation from last year will fall off the annual calculation and hopefully be replaced by more moderate gains of current data.

Simply put, if a 0.4% gain replaces a 0.9% gain from last year, the annual change will drop by 0.5%. (This is what happened in the October data.) In the last two months, the monthly increase has been 0.4%, and if that pace continues, it will replace an average of 0.8% over the next eight months.

So a monthly reduction of 0.4% over the next eight months will take 3.2 percentage points off the annual rate (0.4%*8=3.2%). That will bring the annual rate of the CPI below 5.0%, all else being equal.

Goods

But all else is not equal, and that is the good news. Goods inflation continues to decline as demand for goods has fallen because shopping habits have changed since the pandemic.

Retail inventory continues to climb, and the products are now being discounted, most notably with apparel. Remember Amazon’s Prime Day in October? That wasn’t just to be friendly to the consumer; it had bloated inventories that needed to be reduced. Other retailers also had big sales.

We expect goods inflation to continue to decline.

Services

As for service inflation, that might be close to peaking. A big part of the service component is housing costs, and the pace of upward pricing pressures is slowing under the pressure of higher mortgage rates.

The other part is essential services, with labor costs having increased prices. Fortunately, the pace of labor costs also is slowing. So a combination of the base effect and slowing pricing pressures plays into the market expectation that inflation will decline in 2023.

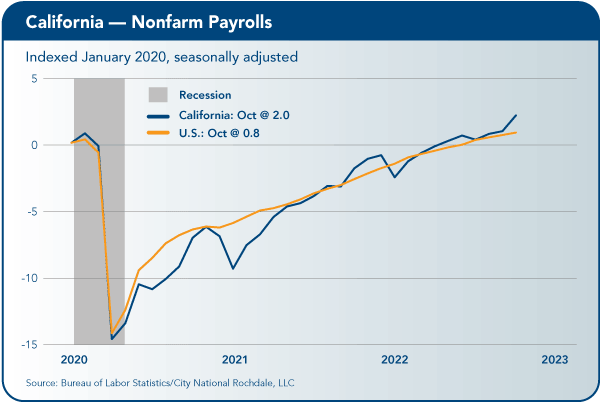

So far this year, payrolls have increased by 4.7 million. That is higher than the average of a good year of growth.

Labor

The labor market remains vibrant. This report was broadly a continuation of the strong labor growth that has been in place all year. So far in 2022, payrolls have increased by 4.7 million, far better than the average growth of 2.3 million in most good years.

The labor market is gradually softening but remains too strong for the Fed’s liking. The persistent worker shortage has led companies to avoid layoffs (you can’t fire someone you never hired), and when employees do quit, companies are quickly replacing the workers who left.

But that will change as the risk of entering a recession increases due to the Fed’s aggressive approach to monetary policy and to domestic and global demand softening, and borrowing costs increasing.

The rebound in job openings from the job openings and labor turnover survey (JOLTs) report and the strength in today’s Non-Farm Payroll (NFP) will not divert the Fed from its plans to raise interest rates. The pace of labor deceleration is not fast enough for the Fed. The imbalance between demand for workers and available workers remains too wide for the Fed’s comfort.

This economic outlook report to the CalChamber Board of Directors was prepared by Paul Single, managing director, senior economist, senior portfolio manager, City National Rochdale LLC.

This economic outlook report to the CalChamber Board of Directors was prepared by Paul Single, managing director, senior economist, senior portfolio manager, City National Rochdale LLC.