One, Two, Three, Cha Cha Cha

One, Two, Three, Cha Cha Cha

No, this is not economics by Arthur Murray, but the process for getting the economy back on track is pretty simple, with the outlook being spectacular.

• Step one: Disseminate the vaccine.

• Step two: Consumers will come out and businesses will begin to reopen fully.

• Step three: Households will spend part of the vast amount of money they have been saving this past year.

The net result: Solid economic growth.

Overview

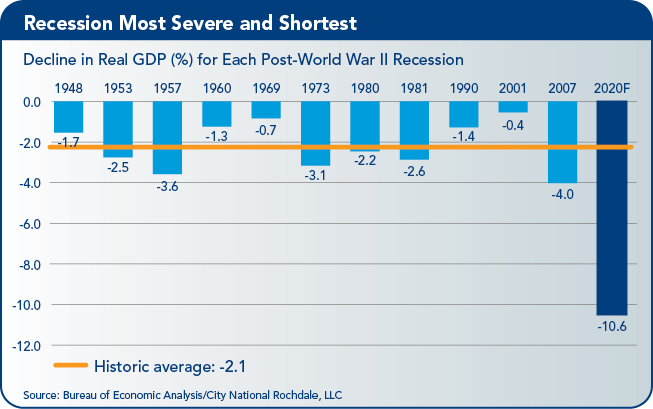

We have a very positive view of economic growth for this year. Our median forecast is 5.0% gross domestic product (GDP) growth, which is above the Federal Reserve’s (Fed’s) median forecast of 4.2%. This belief is predicated on the ability to reach herd immunity by early summer.

We see three driving forces behind this growth: personal spending, housing and manufacturing.

Personal Spending

Households are flush with cash. They have about $1.5 trillion more in cash than they did a year ago. This is due to earnings increasing about $1 trillion while spending fell about $500 billion. To put some perspective on that, $1.5 trillion is greater than 10% of annual expenditures.

Households have a lot of pent-up demand. Once they feel safe to go out in public, they will. It will be like VJ day.

Housing

Record low mortgage rates, growing demand for a larger place to live, a strong balance sheet of buyers, and rallying home prices are all inputs into a strong housing market.

The lack of supply of existing homes is creating strong demand for new homes. This should generate a lot of new jobs. It is not just the home’s construction, but also the manufacturing of products that go into the new house.

Manufacturing

With low inventory levels and a weakening dollar, demand for manufactured goods is strong.

Labor

Labor

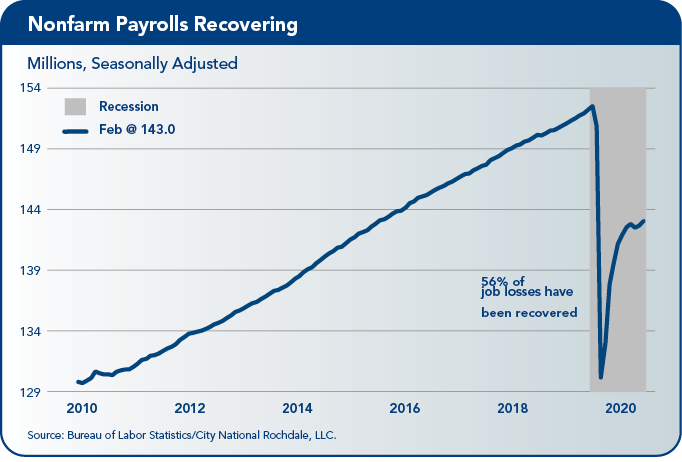

The job recovery has been strong, but there is still a long way to go.

January’s labor report was a disappointment with a monthly gain of just 49,000 and the two previous months being revised down by 159,000. The labor market faltered around year-end due to the pandemic. The financial markets didn’t seem to care much because the report was viewed as old news.

The virus played an essential role in the winter economic lull, but the news is getting better. In early January, infections hit a one-day total of over 300,000 with a seven-day average of about 250,000. Since then, the seven-day average has been on a steep decline to just 66,000. Furthermore, vaccinations have been administered to 63 million people. The outlook is looking good.

But there is a long way to go. Payroll levels are about 10 million below this time last year. Herd immunity will help get most of those jobs back, but full recovery is several years away.

Inflation

Inflation

We believe inflationary pressures remain cool.

Inflation remained tame this past year despite the massive inventory shortages, shipping bottlenecks, and rally in many commodity prices. Inflation remains well below the Fed’s goal and reflects an economy dealing with the pandemic’s global economic slowdown.

Inflation this year will be a roller coaster ride. As the year progresses, the year-over-year calculation will be volatile as months from last year drop off the measure. In the spring of last year, there were several months of negative inflation due to the lockdown and a severe oil price decline. As those drop off the year-over-year calculation, the yearly change will increase. In the past summer, the large increases in inflation as the economy reopened will drop off and cause the yearly calculation to recede.

The pop in inflation will not spook the Fed during the spring. Instead, they will look past these one-time adjustments. They will continue to focus on fundamental changes to the economy that may cause long-term price pressures. The Fed has signaled that they plan to keep the federal funds low even if inflation moves above 2.0%.

There is an intensifying debate about inflation. Some believe it will increase, and they base that view heavily on the federal government’s massive spending on pandemic relief. They also point to other perceived leading indicators like the rally in industrial commodities (oil, copper, lumber, nickel, etc.) and money supply growth.

City National is not in that camp, and we think long-term inflationary pressures will remain benign — it will be several years before the Fed will adjust monetary policy to deal with threat of inflation.

Most of the increased federal spending of the past year has not been stimulus spending; it has been relief spending — it replaced the income lost due to the required lockdown. As for the rally in industrial prices, some of that is due to distribution bottlenecks, and some of that is speculative buying.

We continue to live in a world where supply outpaces demand. Also, the population is growing older, so there is a greater propensity to save rather than spend, reducing consumption and increasing the savings glut, putting downward pressure on prices.

The Fed

Federal Open Market Committee (FOMC) to Remain Accommodative for the Foreseeable Future: The Fed’s current view is that the path of the economy will depend significantly on the course of the virus, including progress on vaccinations.

The Fed will continue to keep short-term interest rates near zero.

City National Rochdale continues to believe the outlook for the Fed is to provide “too much” monetary accommodation rather than “too little.”

The Stock Market

Why is there a disconnect between the economy and the stock market?

The recovery in equity markets has confounded some, given the economic damage created by the COVID crisis. However, it’s important to remember that stock prices are forward-looking in nature. So, from this perspective, it makes sense then that investors have quickly looked past the near-term damage, instead eyeing the reopening of the economy and a rebound in corporate profits.

Another thing to keep in mind is that the stock market is not the economy. Not only are the hundreds of thousands of nonpublic businesses still enduring hardship not counted in major stock indexes, but the market is heavily weighted toward technology companies that have benefited from societal changes forced by the pandemic.

The technology sector comprises 39% of the S&P 500, but only 6.9% of U.S. GDP. In contrast, the service industries most impacted by the crisis (retail, restaurants, hotels, transportation, tourism, and entertainment) amount to 19% of GDP, yet these same industries represent only about 7% of S&P 500 earnings.

Finally, policy actions have played a leading role in the market recovery. Fiscal relief from Washington has, so far, been effective in helping fill the income gap created by the historic spike in unemployment.

Meanwhile, the Fed and other global central banks have implemented unprecedented monetary policy stimulus, which has lowered interest rates driving investors into stocks and provided confidence that policymakers will do whatever is necessary to support financial markets’ economic recovery and functioning.

Ending Thought

The outlook is very positive, but there are risks: the trajectory of the coronavirus, markets could become concerned with the massive amount of outstanding debt, downward pressure on corporate profits, volatility in the value of the dollar, premature tightening of fiscal or monetary policy, increased risk of inflation, or even deflation, to name a few.

We are mindful of these and monitor the risks. We are also on the outlook for new risks.

This economic outlook report to the CalChamber Board of Directors was prepared by Paul Single, managing director, senior portfolio manager, City National Rochdale.

This economic outlook report to the CalChamber Board of Directors was prepared by Paul Single, managing director, senior portfolio manager, City National Rochdale.