With the midpoint of the year fast approaching, two distinctly opposing trends have formed in terms of the U.S. economy’s outlook for the year. On one hand, the nation’s economy is clearly picking up momentum after a year of slow growth in 2016. On the other hand, the policy uncertainties created by the Trump administration have only become worse as it moves into its fifth month.

The U.S. economy may have gotten off to a slow start as far as quarterly gross domestic product (GDP) is concerned with annualized quarterly growth of 0.7%, but the year-to-year growth figure of 1.9% is a better reflection of the general trend and is very much in line with the trajectory of the economy over the past few years.

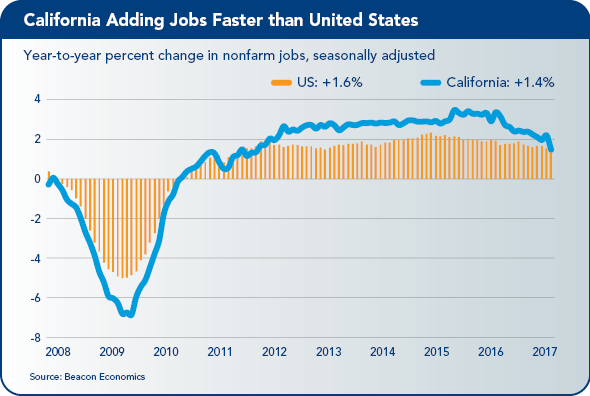

Similarly, wage and salary job growth may be a bit lower than last year at 1.6% year over year, but this is largely due to the fact that the economy has reached full employment, hence adds jobs at a slower pace.

U.S. Outlook

All in all, the outlook for the U.S. economy in 2017 may be summarized in one number: 2! That is, GDP growth of about 2%, job growth of just under 2%, and inflation running at about 2%…at least through the end of this year and possibly into 2018.

As for California, the state economy remains on track (as described below) despite the uncertainty created by the disruptive political environment that has characterized the early months of the Trump administration.

From its opening salvo of backing out of the Trans-Pacific Partnership (TPP), to repeated efforts to enact a travel ban, and other measures to cut regulations, actions by the administration inevitably affect California businesses and must be monitored for their potential implications.

Business leaders have their work cut out as they try to navigate terrain that has been made more uncertain by the current state of affairs in Washington, D.C.

Sustained Growth

The California economy generally outpaced the national economy as it advanced throughout 2016 and into early 2017. The state’s unemployment rate fell to its lowest in 10 years at 4.9% in March 2017, marginally higher than the U.S. rate.

California’s real GDP in all of 2016 grew 2.9% in yearly terms compared to the nation’s 1.5% rate over that period. In general, the pace of economic growth in both California and the United States was slower in 2016 than in 2015, but should speed up this year.

California continues to get significant contributions from the tech-related sectors (Information, together with Professional, Technical, and Scientific Services), Health Care, with noteworthy contributions from Construction and Durable Goods Manufacturing.

The state has continued to experience steady but somewhat slower job growth as it has entered 2017. Wage and salary jobs rose by 2.1% year-over-year in March 2017, somewhat lower than the 2.8% growth rate a year earlier. Even so, California added 346,400 jobs year-to-year in March, well ahead of other states around the U.S. and accounting for approximately one-fifth of all jobs added nationally.

In the private sector, Health Care made the largest contribution, followed by Accommodation and Food Services; Construction; and Professional, Scientific and Technical Services. The government sector saw a significant gain, mostly due to hiring by local school districts. Together, these sectors accounted for 256,000 of the jobs added during the period.

Job losses occurred in Mining and Logging and in Durable Goods manufacturing. On a separate note, Agriculture posted a solid 3.4% yearly job gain in March 2017.

The metro areas of the state universally saw yearly job gains in March 2017. Among the metropolitan statistical areas (MSAs) with more than 100,000 jobs, the Inland Empire led the way with a 3.5% increase from a year earlier, followed by the Oakland MSA, the Ventura MSA, and the Fresno MSA. In absolute terms, Los Angeles County led the way with 72,800 jobs added.

Housing Outlook

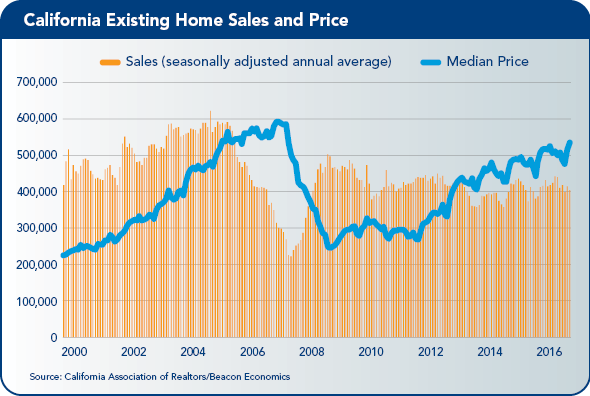

The picture for California housing continues to be mixed. In general, prices have advanced modestly despite less-than-normal circumstances that have limited sales activity. Aside from the San Francisco Bay Area, home prices have yet to surpass their pre-recession peaks.

On the demand side, strong demographics, job and income growth, and low interest rates should be driving sales. However, would-be buyers face impediments in the form of limited inventories, high underwriting standards, and large down payment requirements.

On the supply side, existing home sales have been well below their long-run averages, while new home construction has been relatively weak since the recession. Meanwhile, with the homeownership rate at its lowest level in decades, high demand for rental units has driven rents up and rental vacancy rates down.

The outlook for housing in 2017 should improve. With growing incomes, more households will seemingly be in a position to become homeowners. Moreover, the expectation of higher interest rates should get some would-be buyers off the fence. Whether this sparks heightened activity on the supply side remains to be seen.

Meanwhile, lenders appear to be ratcheting up their lending requirements based on a recently released Federal Reserve Bank Senior Loan Officer Survey.

On the rental side, rent burdens (rent as a share of income) have been rising, elevating concerns about affordability around the state to their highest levels in over a dozen years.

Conclusion/Statewide Policy Issues

It will take time for policy changes in D.C. to work their way through the political process. As such, California and its regions should experience continued growth in economic activity and jobs throughout 2017, with the largest contributions to employment coming from Health Care, Leisure and Hospitality, Construction, and Professional Services.

Meanwhile, California must deal with its own home-grown issues. In addition to housing affordability concerns, the state must face up to long-run water problems, even though the precipitation of recent months has ended years-long severe drought conditions in the state.

And, as the situation at Lake Oroville has demonstrated, decades of neglected maintenance and repairs have contributed to a significant infrastructure investment deficit.

The state and its regions must do more to ensure that the all-important statewide water system, which ties north to south and inland California to coastal California, will be up to the task in the future.

More generally, California must find ways to address and finance its infrastructure needs to support a growing state economy in the decades ahead.

The California Chamber of Commerce Economic Advisory Council, made up of leading economists from the private and public sectors, presents a report each quarter to the CalChamber Board of Directors. This report was prepared by Robert Kleinhenz, Ph.D., executive director of research, Beacon Economics, LLC.

The California Chamber of Commerce Economic Advisory Council, made up of leading economists from the private and public sectors, presents a report each quarter to the CalChamber Board of Directors. This report was prepared by Robert Kleinhenz, Ph.D., executive director of research, Beacon Economics, LLC.