The political-economic environment went from unsettling in the aftermath of the November election to disruptive when President Donald Trump assumed the Oval Office, as the new president moved with lightning speed to sign a string of executive orders that embodied his campaign promises.

The administration soon discovered that signing an executive order is easy compared to execution, at which stage it must answer to the U.S. Congress, the courts and the states.

California’s Trade Ties

California has good reason to be concerned about the moves afoot in Washington. As home to the two largest ports in the Western Hemisphere, a number of other ports and airports that engage in foreign trade, not to mention significant ports of entry on the California-Mexico border, the state economy is hardwired to the rest of the world.

The administration’s decision to withdraw from the Trans-Pacific Partnership (TPP), along with its stated goals of renegotiating the North American Free Trade Agreement (NAFTA) and getting tough on trade with China all have significant implications for California’s transportation and logistics industry, not to mention its exports of services, notably intellectual property in the form of creative content that comes out of Hollywood and other parts of the state.

Regarding the TPP, many of the signatory nations have substantial trade relationships with California and its businesses. This pact would have strengthened these relationships by reducing trade barriers while adding more worker and intellectual protections than in past agreements, thereby reducing friction among nations that are already engaged in vibrant international trade activity.

This includes Japan, which has a significant long-standing relationship with California and the United States as a whole. Similarly, California’s top export markets are Mexico, Canada and China.

Because of NAFTA, raw materials, semi-finished goods, and final goods move back and forth across the borders of the three North American countries. And with the admission of China to the World Trade Organization (WTO) in the early 2000s, trade between China and California increased dramatically.

At a minimum, pulling out of the TPP equates to forgone opportunities on the part of California businesses. As for NAFTA and the U.S.-China trade relationship, the Trump administration has not yet announced any concrete plans, but significant changes could be disruptive to California businesses. More generally, any efforts on the part of the administration to raise tariffs (including a “border tax”) would almost certainly lead to higher prices for California consumers as well as businesses.

Disruption

The Trump administration’s desire to secure the nation’s borders through a travel ban and greater restrictions on immigration also will be disruptive to California’s businesses and its residents.

In 2015, foreign-born residents made up more than a quarter of California’s population, compared to 13% for the nation as a whole. Moreover, most of California’s foreign-born residents are not children but adults, most of whom are a part of the state’s workforce and play integral roles in statewide industries from agriculture to technology.

Efforts to limit immigration have the potential to exact significant damage upon the state’s industries. This is not to say that the nation’s immigration problems should be ignored. Rather, the nation and California are in dire need of a rational immigration policy that acknowledges the importance of immigrants to many vital industries and the broader economy.

Most of the state’s economic growth in recent years has come from a handful of industries that face significant downside risks if the Trump administration makes good on its promises to rewrite trade agreements and get tough on immigration.

So it should be no surprise to see state and local officials, along with business leaders, in California “go rogue” in the coming months as they lead their peers across the nation in challenging the administration on these and other policy fronts, such as environmental regulation and infrastructure investment.

State leaders will need to ensure that decisions in Washington neither trip up the California economy nor work against its businesses and residents.

Slower Growth Ahead

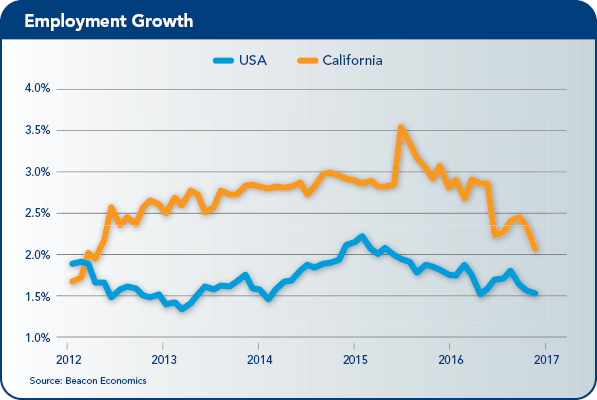

California’s economy behaved much like the nation’s as it moved through 2016. As the labor market tightened, the state experienced steady, but somewhat slower growth. In January 2016, California registered a 2.8% year-over-year growth rate in wage and salary jobs; by December the growth rate slipped to 2.0%.

Meanwhile, the unemployment rate finished the year at 5.2%, down from 5.9% one year earlier, but moving sideways in the second half of the year as the labor force surged with the largest number of entrants to the California labor force since the Great Recession.

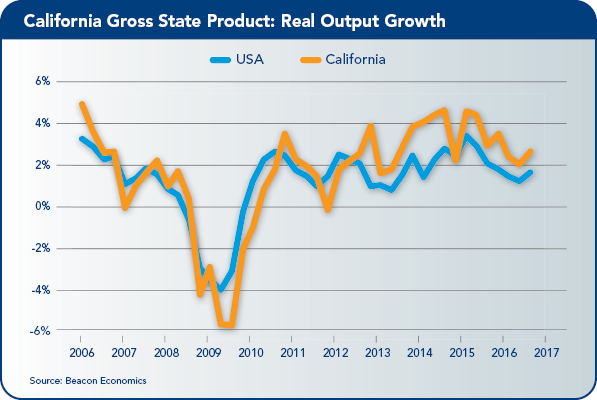

Similarly, economic growth in California continues to expand steadily. In the third quarter of 2016 (latest available data), California’s real gross domestic product (GDP) grew 3.3% over the prior quarter in annualized terms, approximately on par with the nation’s 3.5% rate in that period. For all of 2016, the pace of growth was slower than in 2015.

California’s economic growth continues to get significant contributions from the tech sector, which accounted for 30% of the state’s growth in the third quarter. The transportation and logistics sectors, along with finance and insurance, each accounted for 14% of growth, while durable goods manufacturing accounted for 12%.

From December 2015 to December 2016, California added 332,500 jobs. Health care, leisure and hospitality, and professional services added the largest number of jobs in the private sector, but the government sector posted the largest absolute gains (60,100 jobs), mainly because of increases at the local level (especially public education).

Private education, logistics, and professional services experienced the largest percentage gains, while job losses occurred in manufacturing (-0.6%) and administrative support (-0.5%). Agriculture also posted job gains and finished the year with the highest annual employment on record (428,100 jobs), despite the drought and the strong dollar.

Regionally, virtually all the metro areas of the state saw job gains through 2016. Among the metropolitan statistical areas (MSAs) with more than 100,000 jobs, Santa Cruz led the way with a 4.3% increase from December 2015 to December 2016, followed by San Jose, Sacramento, and the Inland Empire. As usual, Los Angeles County led in terms of absolute job gains (61,300 jobs).

Housing Outlook Mixed

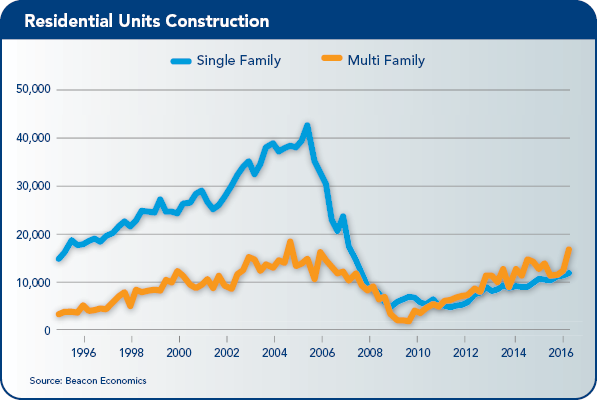

The picture for housing has been mixed in recent years, with prices advancing modestly despite hurdles that have limited sales activity. Outside of the San Francisco Bay Area, home prices have yet to surpass their pre-recession peaks. Demand for homes has been sustained by low interest rates, but also has been impeded by limited inventories, high underwriting standards, and large down payment requirements.

On the supply side, existing home sales have been well below their long-run averages, while new home construction has been relatively weak since the recession. Meanwhile, with the homeownership rate at its lowest level in decades, rental units have been in high demand, driving rents up and rental vacancy rates down.

The outlook for housing in 2017 is mixed. With growing incomes, more households will seemingly be in a position to become homeowners. Interest rates, however, are expected to rise, as will prices, and it appears that lenders are ratcheting up their lending requirements.

A just-released Federal Reserve Bank Senior Loan Officer Survey suggests that already-tight consumer credit standards have become more stringent as the economy’s expansion has lengthened and raised concern in the lending community about a forthcoming slowdown.

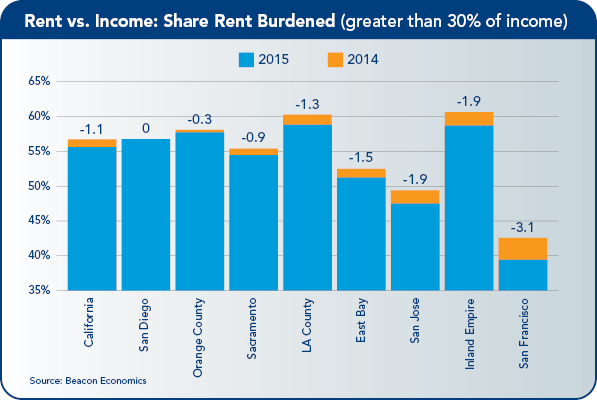

Meanwhile, the rental market will offer little relief as renters face yet another year of rent hikes, prompting concern about affordability in many communities around the state.

Statewide Policy Issues

The year ahead should bring continued growth in economic activity and jobs, with the largest contributions to employment coming from health care, leisure and hospitality, and professional services. The labor force will continue to edge up, but job growth will absorb these entrants with the unemployment rate edging down over the year.

As if the challenges brought on by the new administration in Washington are not enough, California has its own home-grown issues. As mentioned earlier, housing affordability continues to garner attention, both with respect to owner-occupied housing and rentals.

Unfortunately, “head-in-the-sand” approaches, such as building moratoria (e.g., Measure S in the City of Los Angeles) and tougher rent controls, will do little to address the state’s long-term housing needs.

Water Problems

California continues to deal with water problems. Recent rains and snowfall have ended the severe drought conditions in most, but not all, parts of the state. They have also directed collective attention to another challenge: infrastructure.

The recent situation at Lake Oroville has brought the state’s infrastructure needs into greater focus. Decades, not just years, of neglected maintenance and repairs have contributed to a significant infrastructure investment deficit.

The state and its regions must do more to ensure that the all-important statewide water system, which ties north to south and inland California to coastal California, will be up to the task in the future.

More generally, California must find ways to address and finance its infrastructure needs in transportation and other systems to support a growing state economy in the decades ahead.

U.S.: The Unknown Unknowns

The U.S. economy has started 2017 with two distinctly opposing trends forming in terms of the outlook for the year. On one hand, the economy is clearly starting to pick up momentum after a slow year of growth in 2016.

On the other hand, the policy uncertainties created by the surprise election of Trump to the presidency have only become worse. The net result is that while Beacon Economics’ point estimate for growth has been moved up a notch, the range of variance around the estimate is also widening.

Growth in the last quarter of 2016 came in at a weaker than expected 1.9% and is likely to be revised down modestly. But this top line number was pushed down by a very large jump in the nation’s trade deficit.

When looking only at growth in domestic demand (driven by increases in consumer, business, and government spending) we see a 2.6% pace of growth—the best since the third quarter of 2015, with growth in fixed investment as the primary driver.

Momentum Indicators

There are plenty of other indicators that the U.S. economy is gathering momentum. December’s industrial production estimate from the Federal Reserve saw the first year- over-year growth since 2015. The Institute for Supply Management (ISM) indexes for both manufacturing and services popped up in January.

The nation’s proximate sources of strength are readily apparent as well. While the global economy has been struggling with a commodity glut, which hurt U.S. exports and mining activities, the second half of the year saw rebounds in both these areas.

Also significant is the nation’s increasingly tight labor market. The headline U.S. unemployment rate is well below 5%, even as job openings remain near at an all-time high level. The net result has been an increase in wages as well as a sharp acceleration in labor force growth. In other words, President Donald Trump is fortunate to have inherited the strongest economy in the last decade.

Nonexisting Problems

Unfortunately for the President, Candidate Trump ran on a platform that emphasized, not economic strength, but profound weakness. From trade to regulations to immigration to taxes, Trump created straw men to blame for problems that don’t actually exist in the nation.

He has proposed sweeping changes—most of which, by definition, cannot deliver the promised positive effects. The primary impacts of these proposed policy shifts will largely be confined to what economists refer to as the “law of unintended consequences”—the secondary negative impacts that accompany a shift in policy, but are not intended.

One example is the federal budget. President Trump’s administration is proposing broad tax cuts for corporations and individuals, even as it pushes increases in infrastructure and defense spending. Implicit in this proposal is the idea that a surge in economic growth combined with a reduction in wasteful spending and some tax deductions will make these actions largely revenue neutral.

Years-Long Task

While waste certainly exists in the federal system, it is unlikely to be nearly large enough to offset broad tax cuts, and in any case, finding and implementing solutions would take years to accomplish, at best. As for reducing tax deductions (e.g., the mortgage interest deduction or state income tax deduction), as always, the Republicans will figure out that such programs are as popular in red states as they are in blue states.

And of course this entire conversation has aggressively steered clear of the political minefield known as federal entitlements, all of which are about to see a rapid acceleration in spending growth due to the baby boomer generation moving into retirement.

It is no wonder that Janet Yellen’s last speech to Congress came as close to chastising the Office of the President for its fiscal plans as any chairman ever has, given the famously bland nature of their public communications.

Similar arguments can be made around other hot policy items on the presidential agenda, including trade and immigration. In short, the U.S. economic outlook is becoming more worrisome as time passes.

This seems to fly in the face of the stock market’s ongoing rally. But the stock market is strikingly incompetent in recognizing vague threats. Remember that it wasn’t until the failure of Lehman Brothers—during the third quarter of the year-and-a-half-long Great Recession—that the markets finally tanked. The market’s focus is exclusively on profits and the potential for corporate tax cuts.

First-Month Signs

Is it time to pull the rip cord and get out? Probably not. Although the policy promises of the current administration appear to be more dangerous than helpful, what’s occurred during just the first month of this administration begs the question as to whether anything will get done at all.

There are clear signs of infighting among President Trump’s team of advisers, and the lack of government experience is telling. The conflict of interest issues have not been resolved and Las Vegas odds makers are now suggesting that the chance of Trump actually making it through his first term is only slightly over 50%.

If there were a well-defined direction in policy, even if the policies are unwise, it would allow for some clarity on the direction of the economy. But the chaos in this administration leaves us, as forecasters, with little idea as to what might actually occur. As we move through the year, beware the unknown unknowns.

The California Chamber of Commerce Economic Advisory Council, made up of leading economists from the private and public sectors, presents a report each quarter to the CalChamber Board of Directors. This report was prepared by council chair Christopher Thornberg, Ph.D., founding partner of Beacon Economics, LLC.

The California Chamber of Commerce Economic Advisory Council, made up of leading economists from the private and public sectors, presents a report each quarter to the CalChamber Board of Directors. This report was prepared by council chair Christopher Thornberg, Ph.D., founding partner of Beacon Economics, LLC.