With a gross state product of over $4 trillion representing 13.7% of the U.S nominal gross domestic product (GDP) in 2024, California ranks as the fifth largest economy in the world. Here, international trade and investment is a major part of our state’s economic engine with broad-based benefits to our businesses and communities with California’s global exports exceeding $183.3 billion in 2024.

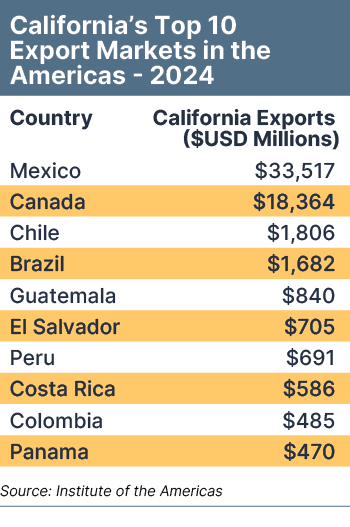

Among California’s trading partners, Mexico and Canada collectively represent nearly 27% of our state’s total exports, with Mexico totaling $33.5 billion and Canada $13.4 billion last year.

In the case of Mexico, its exports to the United States topped $505.9 billion of which $64.3 billion or 12.7% were imports to California. Other leading markets for California-based companies across the Americas include Chile with $1.8 billion export sales and Brazil with nearly $1.7 billion in 2024.

Given the importance of exports to the California economy, there is understandable concern among California’s internationally focused companies specific to the Trump administration’s on-and-off tariffs and the potential economic blowback that retaliatory tariffs could have from some of our state’s existing trading partners if tariffs do, in the end, go through as originally planned.

Upcoming Announcement

More will be known on April 2 in what President Trump is calling “Liberation Day” when his administration plans to announce tariffs on targeted countries, including Mexico and Canada, as part of its America First Trade Policy issued on January 20 and presidential memorandum on Reciprocal Trade & Tariffs issued on February 13. That said, 25% tariffs have been announced on all imported foreign-made autos and additional tariffs are forthcoming on pharmaceuticals and wood products. The announced tariffs will be a big blow to Mexican and Canadian autoworkers.

Beyond already-announced plans, the Trump administration also appears intent on initially applying reciprocal tariffs on a set of 15 countries with persistent trade imbalances. Among the group of nations that Treasury Secretary Scott Bessent calls the “dirty 15” are the United States’ two largest trading partners, Mexico and Canada. Last year, both countries ran trade deficits with the U.S. that totaled $171.8 billion and $63.3 billion respectively.

Value Added Tax Concerns

What remains to be seen, however, is exactly how reciprocal tariffs will be applied. Of particular concern is how the Trump administration classification of “value added tax” (VAT) as an indirect tariff is subject to consideration in their reciprocal tariff calculations.

After all, VAT is a consumption tax that is a norm around the world, in particular across the Americas, and is applied to both domestically produced and imported goods alike. To equate VAT to tariffs can be problematic without taking other factors into consideration.

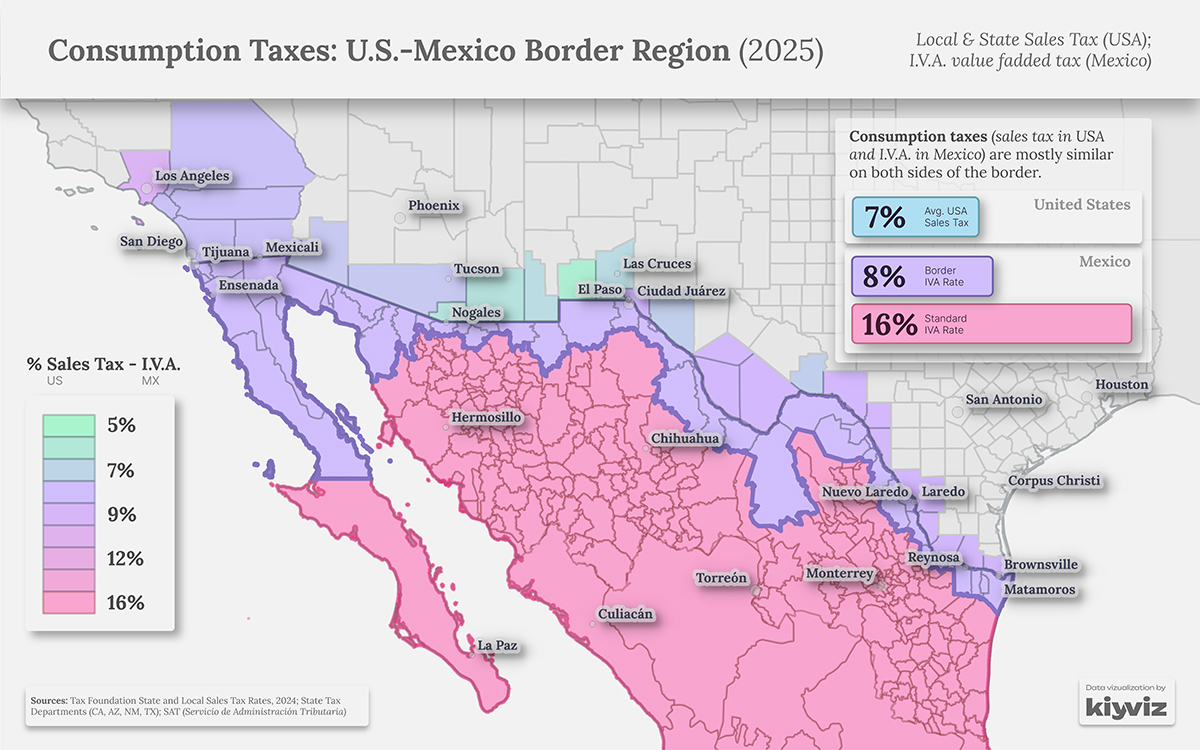

The United States is one of the few countries in the world that does not use a national VAT consumption tax. Instead, state and local sales taxes are applied. Combined average sales tax rates can vary from 2% in Alaska to 10% in Louisiana. Although California has a state sales tax of 7.25%, the local sales tax for Los Angeles County is 3% (10.25% combined) and for San Diego County is 0.50% (7.75% combined). Still, in California basic food products are exempt from sales tax as is the case for many, but not all countries, where VAT is applied. According to the International Monetary Fund, the average VAT rate globally is 15.3%.

Canada/Mexico Taxes

Among our U.S.-Mexico-Canada Agreement (USMCA) trading partners, Mexico has a VAT (otherwise known as IVA) of 16% and Canada has a national VAT equivalent — goods and services tax (GST) — of 5% although additional provincial taxes also apply. That said, in both countries basic foodstuffs and essential medicines are exempt from VAT.

In the case of Mexico, within its northern and southern border frontiers a reduced 8% IVA rate applies, to remain competitive with U.S. sales taxes. This reduced rate applies to 43 municipalities in the northern border region within 100 kilometers of California, including: Tijuana, Rosarito, Ensenada, Tecate, Mexicali in the state of Baja California.

So, at least for Mexico’s border cities, if reciprocal tariffs were to be equitably applied to imports originating from this region (including products produced in border area maquiladora manufacturing/assembly plants), the net tariff should be marginal if tariffs were applied equitably and aligned with the corresponding state and local sales tax rates for their corresponding U.S. border sister cities.

Reciprocal Tariff ‘Breaks’?

Right now, countries beyond the dirty 15 do not appear to be targets of the Trump tariffs. In fact, on March 24, Trump noted, “I may give a lot of countries ‘breaks’ on reciprocal tariffs.” So, if breaks are, in fact, given to the other countries across Latin America and the Caribbean, including those countries with pre-existing trade agreements — including CAFTA-DR [Central American Free Trade Agreement-Dominican Republic], Chile FTA, Panama FTA, Colombia TPA [Trade Promotion Agreement] and Peru TPA — this could result in opportunities for future trade and investment that could spur expanded economic growth in the region.

Businesses in the San Diego-Tijuana border region are also hoping the “breaks” that Trump is referring to also apply to their products given the lower IVA rates at the border.

Opportunity: Americas Act

Here, an opportunity exists through the Americas Act, a bipartisan initiative, co-sponsored by U.S. Senator Bill Cassidy (R-Louisiana), intended to “establish a regional trade, investment, and people-to-people partnership of countries in the Western Hemisphere to stimulate growth and integration through viable long-term private sector development.”

Key provisions of the Americas Act include: regional trade expansion through the establishment of an Americas Partnership providing a potential pathway for countries like Uruguay and Costa Rica to join the USMCA, thereby creating a more integrated and resilient regional economy; investment promotion with an emphasis on nearshoring and bolstering regional supply chains, strengthening hemispheric energy security and enhancing e-governance across the Americas.

If President Trump gets things right and takes a measured and fair approach to tariffs with countries across the Americas, including Mexico, he and his administration have a historic opportunity to leave a lasting legacy across the hemisphere that will not only make the United States more secure but also build a brighter future for people across the Americas which, over time, will also reduce migration pressures along the U.S. southern border.

Richard Kiy is president and CEO of the Institute of the Americas, an independent, nonpartisan nonprofit organization located in La Jolla, California with a mission to promote economic development and regional integration across the Americas.